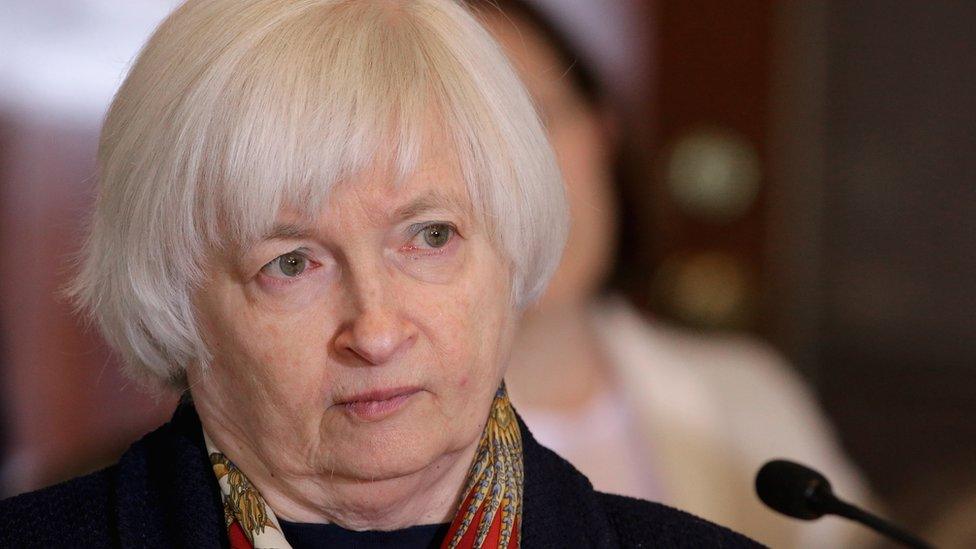

Fed's Janet Yellen says case for rate rise has strengthened

- Published

The case for raising US interest rates has "strengthened", the head of the Federal Reserve has said.

Speaking at an annual meeting of central bankers, Janet Yellen was cautiously upbeat about the US economy.

She said economic growth and a stronger jobs market meant "the case for an increase in the federal funds rate has strengthened in recent months".

There has been a growing expectation that US interest rates will rise this year.

Some economists are saying that the next hike could even come next month.

The central bank raised interest rates at the end of last year for the first time in nearly a decade, but has held them steady amid concerns over persistently low inflation.

'Gradual' rises

Ms Yellen, speaking at a three-day symposium in Jackson Hole, Wyoming, did not comment on when rates would rise. But she said "the US economy was nearing the Federal Reserve's statutory goals of maximum employment and price stability".

She added: "In light of the continued solid performance of the labour market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months."

Consumer spending grew faster than initially estimated in the second quarter of the year

However, Ms Yellen emphasised that future rate increases should be "gradual".

She noted that inflation is still running below the Fed's 2% target, but said this is being depressed mainly by temporary factors.

Growth data

Subadra Rajappa, head of rates strategy at Societe Generale, in Washington, said: "We weren't really expecting her to signal a hike at the September meeting, but she's just kept the door open for a hike sooner rather than later.

"I think that the Fed wants to get the market to start pricing in a hike for this year, which they weren't doing earlier, and now I'm seeing the probability of a hike by December has gone up slightly over a coin toss."

John Canally, economist at Boston-based LPL Financial, added: "It looks like she is warming a little more to a hike this year, probably not September but probably December."

Signs of slow improvements in the US economy came in data published on Friday. Although the growth rate of second quarter GDP was revised down slightly, from an annual rate of 1.2% to 1.1%, consumer spending - which makes up more than two-thirds of US economic activity - was revised up from 4.2% to 4.4%.

Separately, US Labor Department figures showed that initial claims for state unemployment benefits slipped 1,000 to a seasonally adjusted 261,000 for the week ended 20 August. It was the third straight weekly decline in claims.

On Tuesday, Commerce Department data showed that US new homes sales jumped in July to their fastest rate in nearly nine years.

Ms Yellen's remarks helped lift US share markets in early trading, but stocks began to drift slightly lower in afternoon trading. On the currency markets, the dollar was flat against the euro at $1.1286 and slightly lower against the yen at 100.28 yen.

- Published23 August 2016

- Published21 August 2016

- Published16 August 2016