Debit card control lets you 'turn off' card to beat scams

- Published

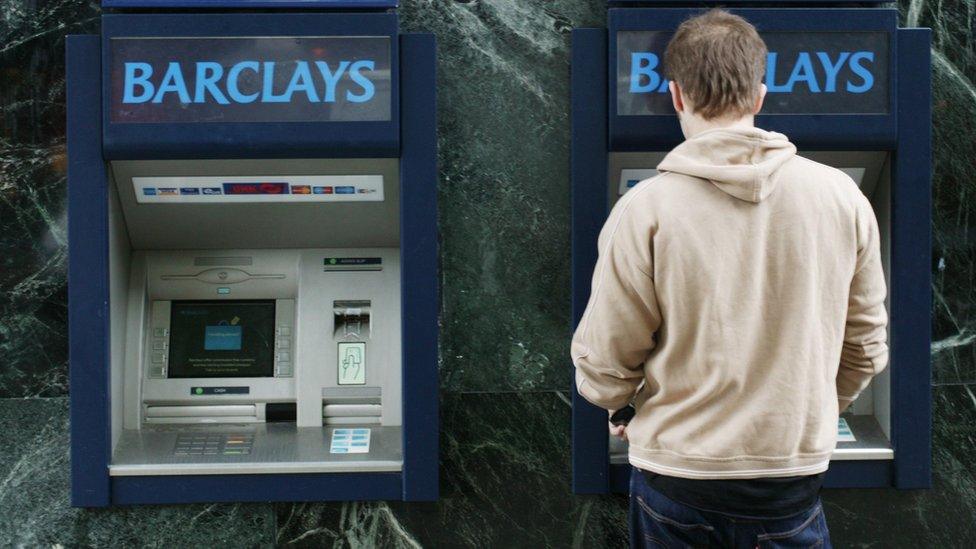

High Street bank Barclays is allowing customers to "turn off" their debit card to online purchases or set daily ATM limits to reduce scams.

It believes that cardholders would be more protected from con-artists if they could block the card from remote purchases at certain times.

The bank's app now includes an option to reduce daily ATM withdrawal limits, from the typical level of 拢300.

Such a move would reduce any losses from thefts at cash machines.

Fraud losses across all payment cards, remote banking and cheques in the UK totalled 拢769m in 2016, according to Financial Fraud Action, the industry's anti-fraud body - an increase of 2% on the previous year.

There were a total of 1.9 million cases of financial fraud during 2016.

Barclays said that while frauds, such as identity fraud, led to full compensation to customers, this was often not the case from scams.

Online shopping scams, for example, could lead to significant losses for victims, if banks were not able to step in before payments went through.

The bank claims that its option to control debit card use - such as blocking remote use and plans to introduce a temporary block on any transactions - was a first among High Street banks. Barclays has 24 million UK customers, of which about five million have the app.

The aim is to block any opportunity for a con-artist to go on a spending spree, were they to trick somebody out of the card details.

The official launch of the service coincides with a major advertising campaign by the bank about the threat of fraud.

"As a society our confidence in using digital technology to shop, pay our bills and connect with others has grown faster than our knowledge of how to do so safely," said Ashok Vaswani, chief executive of Barclays UK.

"We all need to boost our digital safety levels in order to close the gap."

However, critics have consistently challenged the banking sector for failing to protect customers adequately from the threat of fraud.

- Published5 May 2017

- Published31 March 2017

- Published15 March 2017