Watchdog faces probe over LCF collapse

- Published

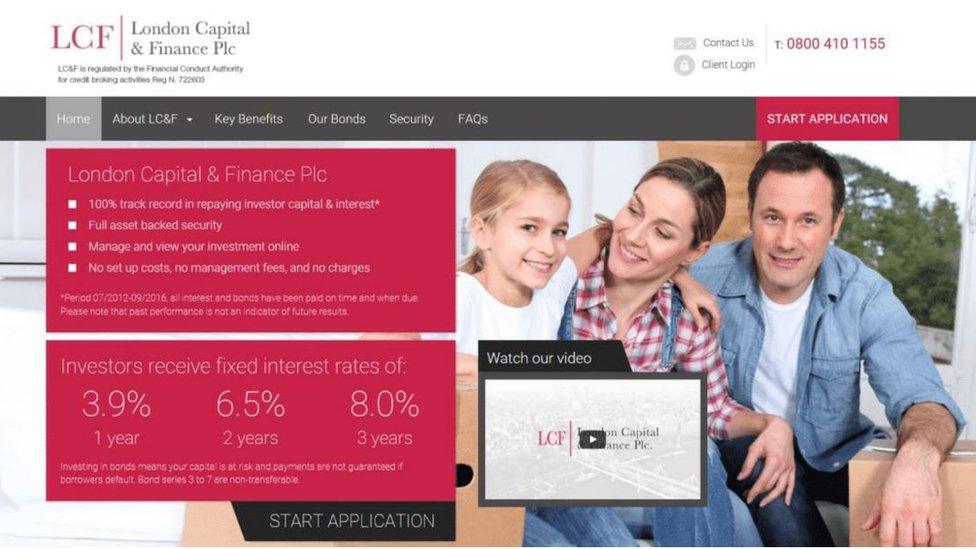

LCF promised returns of 8% for people investing for more than three years

The Financial Conduct Authority is facing a government probe into its oversight of London Capital & Finance (LCF), after customers of the firm lost thousands of pounds in investments.

It follows concerns the FCA was too slow to protect consumers before LCF went into administration last month.

Some 11,605 people invested a total of ВЈ236m with LCF, but only about 20% of this money may end up being recovered.

The Treasury, which will run the probe, said it was "incredibly concerning".

The Economic Secretary to the Treasury, John Glen, said: "By ordering this investigation, we will better understand the circumstances around the collapse and make sure we are properly protecting those who invest their money in the future."

LCF enabled consumers to invest in high-risk investments called mini-bonds, but it was accused of not explaining the risks to customers.

The FCA began an investigation into its advertising practices in December, but a month later the firm had stopped trading.

Several independent financial advisers have since said they warned the FCA as far back as 2015 about the firm's "misleading [and] inaccurate" adverts.

And Nicky Morgan MP, chair of Parliament's Treasury Committee, has written to the FCA's chief executive asking what it knew about LCF's advertising, and when.

In a statement on Monday, the FCA said the investigation would cover:

Whether regulations adequately protect retail purchasers of mini-bonds from "unacceptable levels of harm"

The FCA's supervision of LCF

Many people who put money into LCF were first-time investors - inheritance recipients, small business owners or newly retired people.

And many say they believed they were putting their money into safe, secure fixed-rate ISAs.

Amanda Cunningham, a former customer of LCF, told the ґуПуґ«ГЅ she had lost thousands of pounds in savings she had put aside for her autistic son.

Amanda Cunningham, who lives near Burnley, says she's lost her life savings

"Basically it will mean that my son will not have money for his future," she told the ґуПуґ«ГЅ.

As mini-bonds are unregulated, LCF customers are not entitled to redress under the Financial Services Compensation Scheme.

Finbarr O'Connell, one of the administrators, told ґуПуґ«ГЅ Radio 4's Money Box that he hopes to recover about a fifth of the capital people invested with the firm, but it would probably take at least two years before customers saw any of that money.

"They [investors] thought this was a safe option, they were comfortable their capital was safe and they thought they would get a good rate of interest so they're completely devastated," he said.

Separately the Serious Fraud Office (SFO), which is also investigating LCF, says it has arrested four people, who have all been released pending further investigation.

The names of the people arrested have not been confirmed yet, which is standard practice for the SFO.

- Published26 March 2019