AstraZeneca: Jeremy Hunt 'disappointed' by drugs firm's low-tax move

- Published

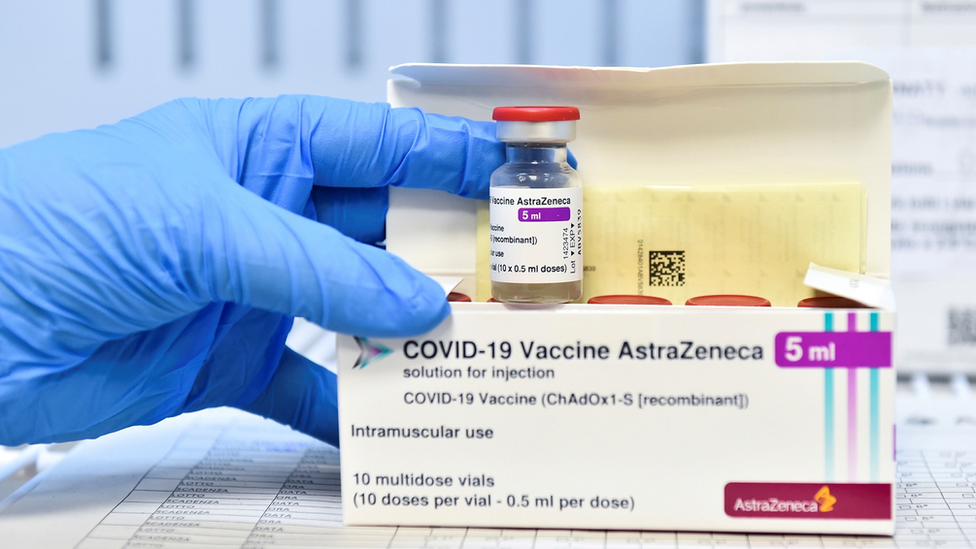

AstraZeneca developed a Covid vaccine with the University of Oxford

Chancellor Jeremy Hunt has said he is "disappointed" drugs giant AstraZeneca has chosen the low-tax Republic of Ireland over the UK to build a new ТЃ320m factory.

The firm's chief executive said it had wanted to build the site in north-west England, but the "discouraging" tax rate meant it chose Dublin instead.

Mr Hunt said he agreed with the firm's "fundamental case" on business taxes.

But he said the government would not consider tax cuts funded by borrowing.

AstraZeneca is the UK's biggest publicly listed company and has its headquarters in Cambridge.

The firm already has sites close to Macclesfield, Cheshire, and had originally wanted to build its new factory nearby.

It says the planned Dublin factory is expected to create around 100 skilled jobs.

Mr Hunt told the ДѓЯѓДЋУН: "We're disappointed that we lost out this time. And we agree with the fundamental case they're making which is that we need our business taxation to be more competitive and we want to bring business taxes down.

"But the only tax cuts we won't consider are ones that are funded by borrowing because they're not a real tax cut. They're just passing on the bill to future generations."

He added: "If you look at life sciences, we have billion pound investments announced recently by BioNTech, by Moderna, by Merck, by other big pharmaceutical companies. We think we are in a tremendously strong position, with the biggest Life Science Centre in Europe.'

In April corporation tax, which is paid by UK companies and foreign firms with UK offices, is due to increase from 19% to 25%.

Dr Richard Torbett, chief executive of the Association of the British Pharmaceutical Industry, said: "There are more stories about losing investment, like the one we've seen with AstraZeneca, than the positive noise stories coming in, and we really have to turn that around."

AstraZeneca and others in the sector have also expressed concern about the NHS-branded medicines sales levy, which has soared because of rising demand since the Covid pandemic.

Dr Torbett told ДѓЯѓДЋУН Radio 4's Today programme: "The agreement we have with the NHS, that has got to the point where companies are now paying more than a quarter of their revenues - not profit but revenues - back to the government.

"That is vastly in excess of anything the industry pays anywhere else in the world and we have to get to the point where the UK is able to compete for investment on a level playing field, and we are not there yet."

Conservative MP Sir John Redwood said the UK was "being undercut mercilessly by the Irish tax system".

Sir John is member of the Conservative Growth Group of backbench MPs, calling for a return to ex-PM Liz Truss's tax-cutting agenda.

Mr Hunt has warned it is unlikely there will be any room for "significant" tax cuts in the Budget in March.

It comes as new figures show the UK narrowly avoided falling into recession in 2022, after the economy saw zero growth between October and December.

The Bank of England still expects the UK to enter recession this year - usually defined as when the economy shrinks for two consecutive three-moth periods.

Related topics

- Published10 February 2023

- Published27 January 2023