Zimbabwe hails gold coin success and wants to issue more

- Published

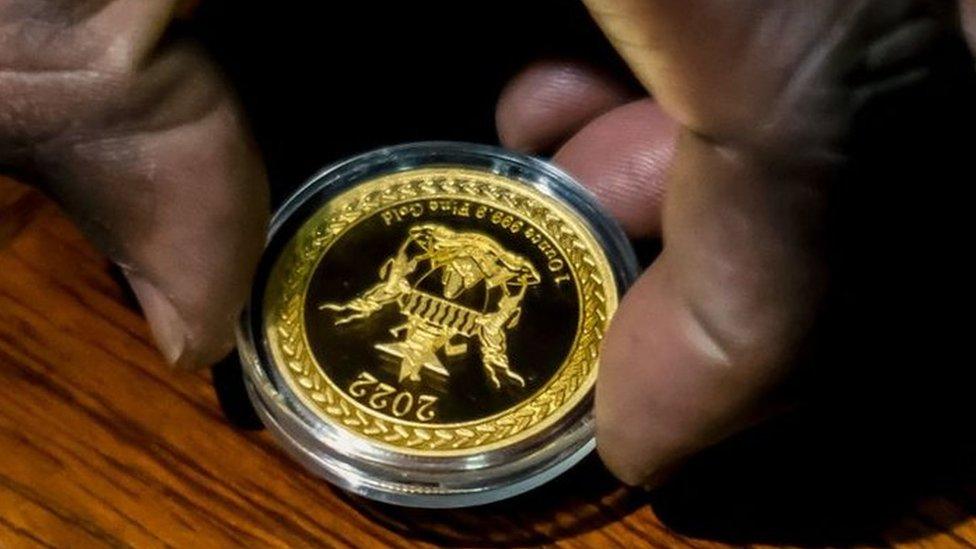

Last month saw a gold coin worth $1,800 (£1,483) introduced

Gold coins used as currency in Zimbabwe will soon be available in smaller denominations, the central bank says.

Sky-rocketing inflation saw people rushing to cash in their Zimbabwean dollars for US dollars, to stop their savings losing value.

This led to a shortage of US currency and drove up exchange rates, so the central bank reacted by halting loans.

But it soon changed tack, and last month issued gold coins worth US$1,800 instead, to ease demand for US dollars.

Those higher-value gold coins are available to buy at approved banks and are tradeable locally.

The average yearly salary in Zimbabwe for a civil servant is US$2,600, and according to the state-affiliated Herald newspaper 4,475 gold coins have been sold since their introduction last month.

This makes it a success in the eyes of the central bank.

The lower value US$180 gold coins are to be released in November, the Herald reports.

Zimbabwe's current economic woes are not as grave as in the early 2000s when hyper-inflation reached record levels and local currency was abandoned altogether.

Nor has the country quite reached the levels of 2008, when many ordinary people's pensions and savings were wiped out after the Zimbabwean dollar crashed.

However President Emmerson Mnangagwa, who succeeded Robert Mugabe after his ousting by the military in 2017, has failed to revive the national economy despite promising to raise it to by 2030.

Zimbabwe still uses two main currencies, the US and the Zimbabwe dollar, with most people preferring to exchange their local dollars for foreign currency to maintain value.

Inflation topped 256% in July - and the local currency tumbled in worth from Z$108.66 to US$1 at the start of the year, to Z$481.85 to US$1 in August.

Reaction to the coins has been mixed. Some say they are good for companies wanting to maintain value of their money, but others say the majority of Zimbabwean workers will still not be able to afford them.

Related topics

- Published13 August 2019

- Published22 September 2018

- Published30 August 2023