Canada student travels world for free with 'manufactured spending'

- Published

A Canadian graduate student has become an expert at living the champagne lifestyle on a beer budget.

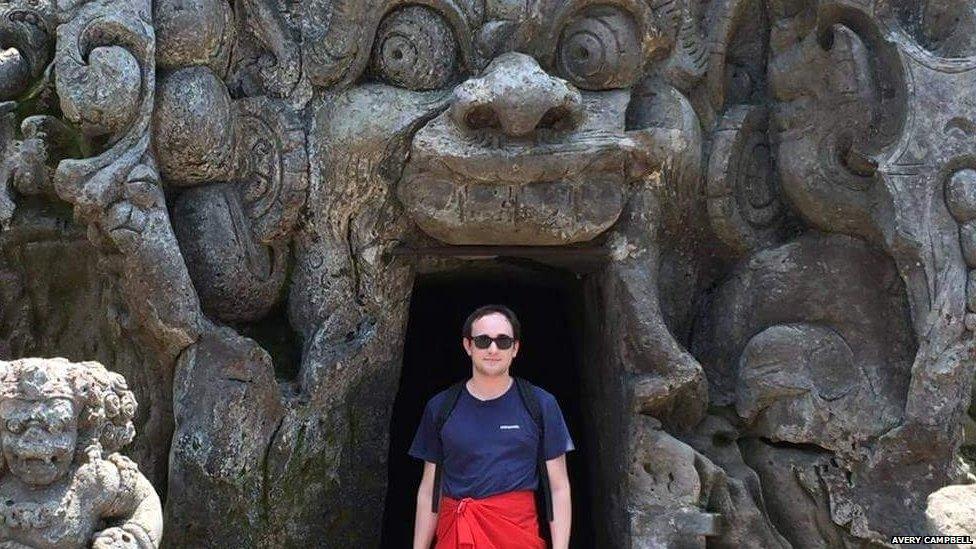

Avery Campbell, 24, uses a strategy called "manufactured spending", which means shopping just to earn points on credit-card rewards programmes.

Recently he bought coins from the Canada Mint to collect points, then used the same coins to pay his bills.

The scheme has helped him travel to "every inhabited continent" - sometimes first-class - for little or no money.

"I have pretty darn good credit," he told the ┤¾¤¾┤½├¢ while waiting to board a flight to Chicago where he will be attending a manufactured spending conference.

The British Airways flight would have cost about C$400 ($314, £238), he says, but he used his points. This time he flew coach, but he has travelled first-class on Lufthansa and Emirates airlines.

He says he has never missed a payment and does not carry a balance on his cards.

Manufactured spending works when customers are able to buy something on their credit cards that can be used like cash, collecting points essentially for free.

Mr Campbell uses these loopholes to help him do something called "credit-card churn", which is when you sign up for a new credit card in exchange for a large amount of reward points.

Most credit-card companies have a minimum amount a customer must spend in order to qualify for the points.

In the case of the Canadian Mint, Mr Campbell was able to collect points from buying the collectors coins on his credit card, then pay back that same purchase using the legal tender.

These purchases helped him meet his minimum spend quickly, and without incurring debt.

The loophole was enabled by the Mint itself, which created a Face Value programme in 2011 that was supposed to entice people into coin collecting by offering coins at face value.

The programme is no longer in effect, but before it ended, staff at the Canadian Mint store in Ottawa had caught on to Mr Campbell's scheme.

"Near the end, they started saying no," he said. "I stopped when they told me."

Although merchants frown on manufactured spending, there is nothing illegal about it, Mr Campbell said.

Usually when merchants catch wind that people are taking advantage, they close the loophole.

For that reason, Mr Campbell and others like him can be quite guarded.

"It's a very hush, hush community, I'd like to decline to answer that," he said, when asked about his other strategies.

- Published6 November 2012

- Published16 November 2017