Wealth of ports and merchants

Bristol

In the early 18th century Bristol dominated the British end of the slave trade. Bristol merchants established strong trade links with West Africa. The boom for Bristol was created through this slave trading success. Industries such as sugar-refining grew as a result of the slave trade.

Liverpool

Liverpool also grew into a powerful city, directly through the shipping of enslaved people. By the end of the 18th century Liverpool controlled over 60 per cent of the entire British slave trade. Liverpool's cotton and linen mills and other subsidiary industries such as rope-making created thousands of jobs supplying goods to slave traders. By the 1780s, Liverpool had become the largest slave ship building site in Britain.

Glasgow

Other ports such as Glasgow profited from the slave trade. In Glasgow the tobacco trade contributed hugely to the profits and development of the city. The 'tobacco lords' as the merchants of Glasgow became known, made a lot of money dealing in tobacco, not from dealing in enslaved people directly.

London

London was already trading in enslaved African people before 1700. It continued to be Britain's main port for slave ships, but merchants found other ways to make money. The Atlantic trade, including the slave trade, provided the impetus to develop merchant banking.

Growth of merchant banking

Merchants made their money from buying goods at low prices and selling them at high prices. But they didn't receive this profit until after the voyage and after the goods had been sold. A voyage could take six months or longer.

In the meantime, merchants had to finance the voyage, paying for the ship and sailors. They also carried the risk that the ship might be lost at sea. It was also up to the merchant to find outlets to sell the goods.

Specialist skills developed around each part of the process of trading. Financial, commercial, legal and insurance institutions emerged to support the activities of the slave traders:

- David and Alexander Barclay set up Barclays Bank

- Sir Francis Baring started Barings Bank

- London became a centre for marine insurance. Lloyds of London, founded in 1688, is still the world's leading insurance marketplace.

Atlantic slave trade profits also went to anyone who was wealthy enough to buy shares in the newly invented joint stock companies.

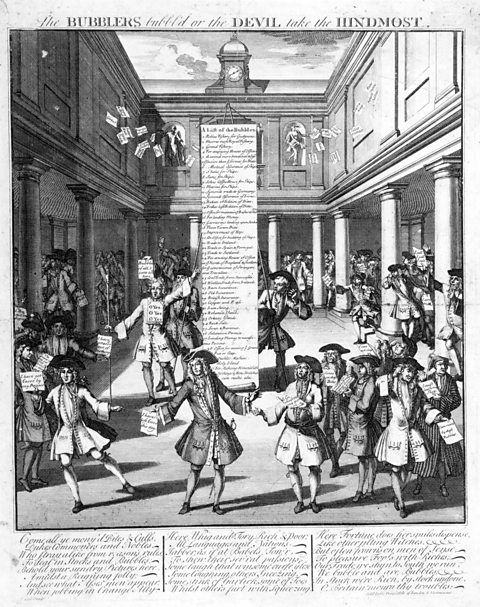

The South Sea Trading Company was set up in 1711, and it invested in the slave trade and in plantations. Its shares were very popular and rose rapidly in value. This led to the first "boom and bust" in Britain, the South Sea Bubble of 1720. The profits from the South Sea Trading Company were spread throughout the upper classes.