The challenge

Video summary

Cat Henstridge (Cat The Vet ) covers everything you need to know about budgeting if going to university.

When you go to university you usually have to pay fees to the university, and you need to have money for living costs such as rent and food. Most students get a student loan to cover the fees and the cost of living.

There are other forms of borrowing including overdrafts, credit cards and mortgages. 'Payday' loans can have sky-high interest rates.

Taking out a student loan can be a daunting prospect, but it's important to remember that it can also be a valuable investment in your future. With a degree, you'll likely have access to better job prospects and earning potential, which can help you to pay off your loan more quickly. It's also worth exploring other sources of funding, such as scholarships, grants, and bursaries, to help reduce the amount you need to borrow. Whatever you decide, it's important to carefully consider your options and plan for how you will repay your loan once you graduate.

All information correct as of March 2023.

Challenge round-up

Cat the Vet summarises the key considerations for the challenge.

Teacher notes

Choose from a selection of activities to help students learn more about debt and going to University.

Before watching

Questions to get the class thinking and talking:

- What are University fees?

- Where do most people get their student loans from?

- What should you consider before borrowing money?

Establish 'debt' is money you owe and 'credit' money you borrow. Before you borrow money, you should know how much you'll have to pay back, how you'll afford it and when you'll have to do it.

Using the film

You may wish to play the films twice: once straight through and once with pauses, to take students' comments and questions. Encourage the students to make notes as they watch.

After watching

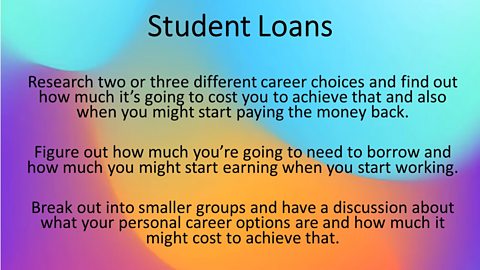

Group discussion - Ask the question 'What do you think going to University will be like?' Some students may think it will be liberating, others may think that it will be challenging.

Invite students into the 'hot seat' to play a future version of themselves at the age of 18. Encourage their classmates to interview them.

What are their thoughts as they embark on their next steps after education? Are they thinking of attending university or starting a job or an apprenticeship? What are they looking forward to? What are they dreading? Are their priorities different from when they were at school? What advice would the тFuture Youт give to the тPresent Youт?

Activity ideas

- Glossaries - Students could compile glossaries of financial terms used in the film clip, along with their own definitions. This encourages them to clarify their understanding of key vocabulary.

Terms might include: 'credit', 'debt', 'interest', 'interest rate', 'Annual Percentage Rate (APR)', loan', 'student loan'.

Quiz questions - Using a true-or-false format, students could compile quiz questions and answers based on their viewing of the film. For example: 'True or false? The fee which student loans are paid back is ТЃ32,000. (False)'.

Borrowing plan - Ask, 'Before you borrow money, you should decide for how you'll pay it back. What would this plan look like?' The students might suggest listing their income and outgoings, to see what they can afford.

Point out that, even if the APR and monthly payments seem low, when a loan runs for a long time it ends up costing a lot to borrow a little.

Supported learning and SEN

Students could (with any necessary support) take a screengrab from Steph McGovern's film and add their own speech bubble, e.g., 'tell the bank before you go overdrawn'. A collection of 'Steph Says' captures and captions could form a financial education comic strip.

Follow-up task

Ask students to imagine they are going into Dragons Den to pitch to the dragons for a ТЃ10,000 to support their next steps after their GCSEтs. This could be to support them to go onto university, or to pay for equipment for an apprenticeship or premises to start their own business etc. They should consider both what they would use the money for and why the Dragons should lend them the money т how will it be put to good use т would the Dragons see a return on their investment?

This short film meets and extends curriculum requirements for financial literacy at:

- Key Stage 3 and Key Stage 4 in England (Citizenship and Personal, Social, Health and Economic Education)

- Wales (Mathematical Development and Personal and Social Education)

- Northern Ireland (Mathematics and Numeracy and Learning For Life and Work)

- Third and Fourth Level and the Senior Phase in Scotland (Mathematics and Numeracy, Social Studies and Learning, Life and Work).

Where next?

Tax budget challenge with Cel Spellman. videoTax budget challenge with Cel Spellman

Actor and presenter Cel Spellman explains how the tax system works and sets a related tax budget challenge.

Party budget challenge with Gayle Chapman. videoParty budget challenge with Gayle Chapman

Food vlogger Gayle Chapman explains how borrowing money works, before setting students a party budget challenge.

Long-term saving challenge with Iona Bain. videoLong-term saving challenge with Iona Bain

Financial journalist and author Iona Bain explains the importance of saving and sets a long-term saving challenge.

Sticking to a budget challenge with Liam MacDevitt. videoSticking to a budget challenge with Liam MacDevitt

Former professional footballer Liam MacDevitt sets students a challenge to plan and stick to a budget ahead of a trip with friends to a football match.

Iona Bain's money jargon busters. videoIona Bain's money jargon busters

In these short videos for secondary schools Morning Live's financial expert Iona Bain clearly explains pensions, mortgages, inflation, interest rates, credit and pensions.

Financial literacy with Steph McGovern. collectionFinancial literacy with Steph McGovern

In these short films for secondary schools Steph McGovern breaks down some key areas of study for the topic of financial literacy. These four short films will provide secondary students with a good understanding of credit, debt, pensions and how interest and taxation works.